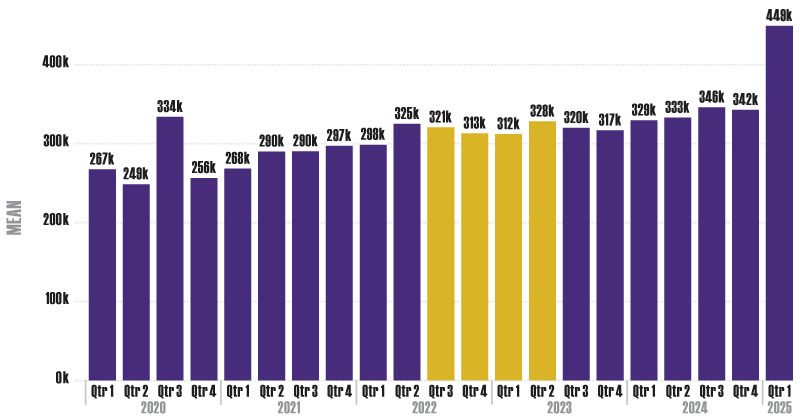

As I present this 2024 Quadrennial Reassessment Report for St. Tammany Parish, I want to take a moment to reflect on the progress, challenges, and responsibilities that have both defined the last four years and will affect us moving forward.

As I present this 2024 Quadrennial Reassessment Report for St. Tammany Parish, I want to take a moment to reflect on the progress, challenges, and responsibilities that have both defined the last four years and will affect us moving forward.

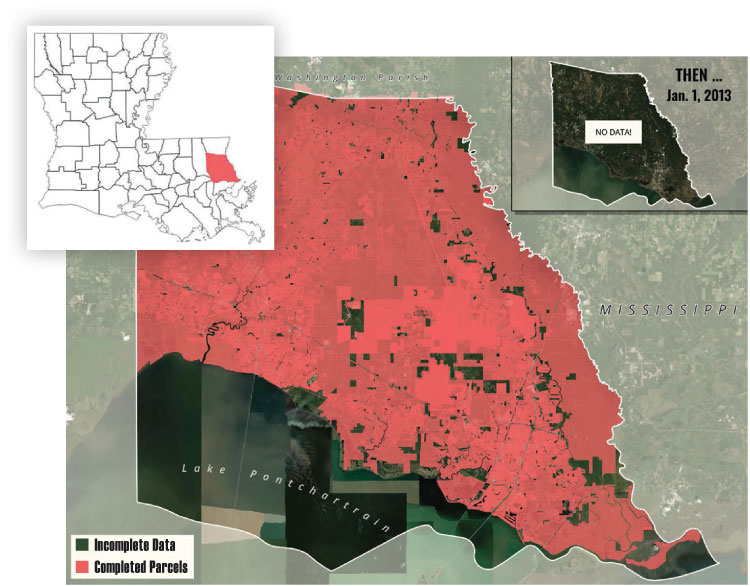

This reassessment cycle was shaped by innovation and accountability. My team and I successfully implemented a modern assessment software system, substantially completed a parish-wide GIS mapping project, and deployed advanced technology that has significantly enhanced how we manage data, enforce policy, and carry out procedures. These improvements allowed us to conduct this reassessment thoroughly, efficiently, and in full compliance with the law. I am incredibly proud of my dedicated team who helped make this challenging reassessment a success.

One of the most encouraging outcomes, however, was the remarkably low number of formal appeals. Only about 100 assessments–out of more than 130,000–were sent to the Board of Review. That reflects not only the accuracy of our work, but also the fairness of the values we assigned.

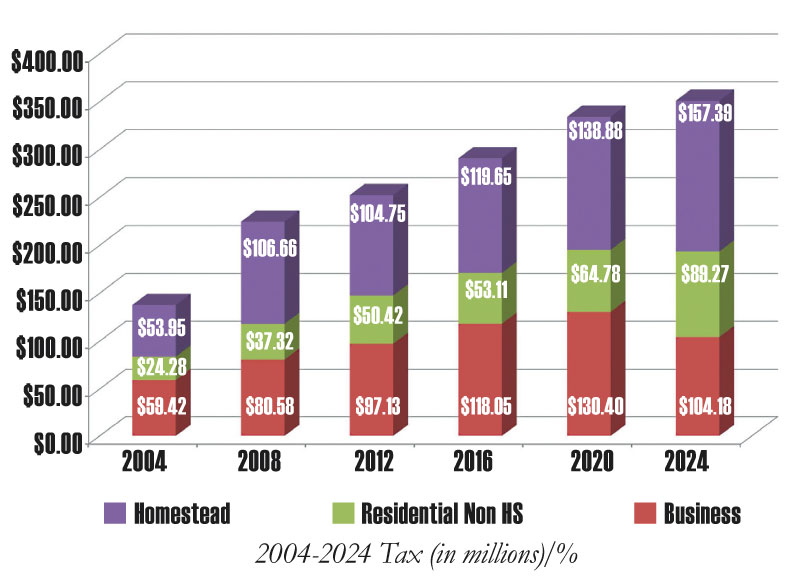

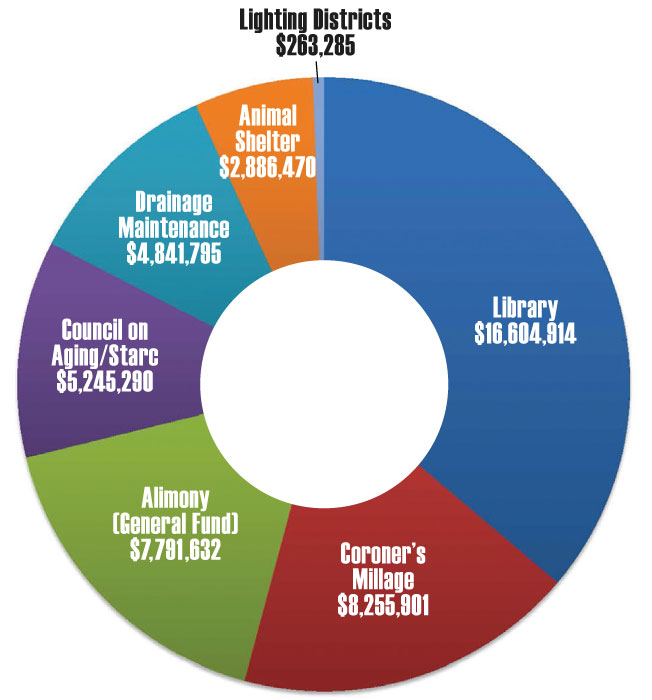

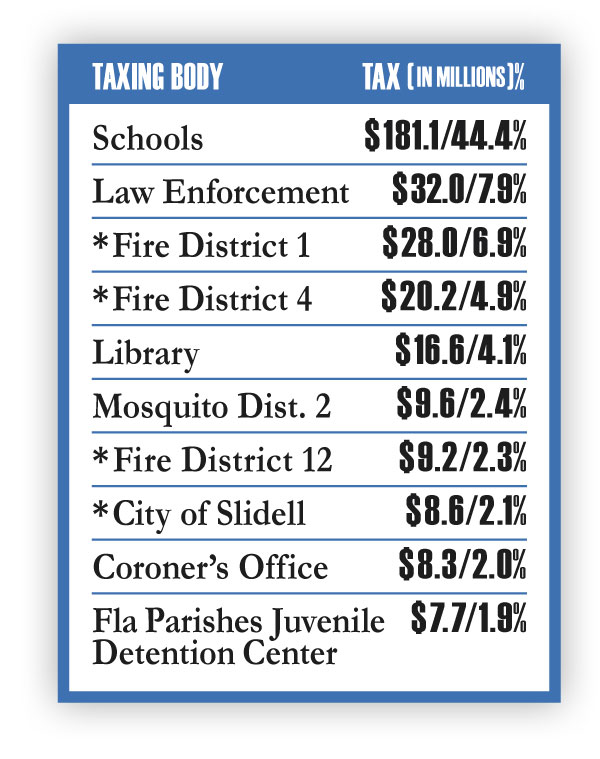

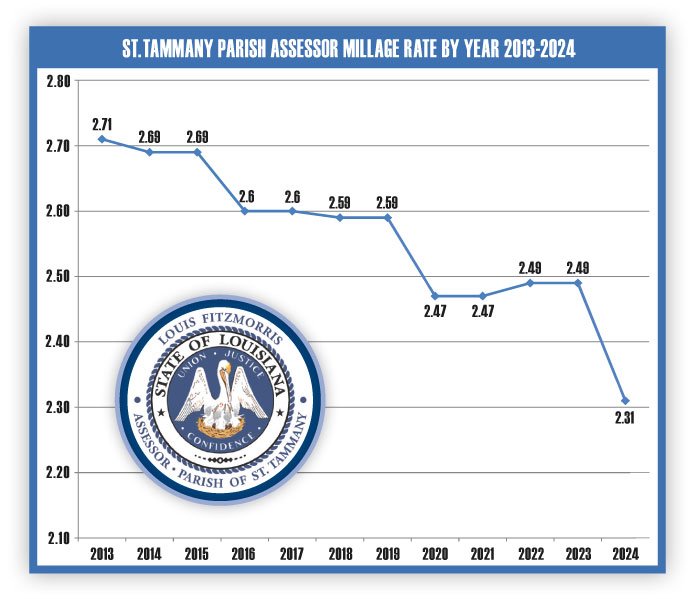

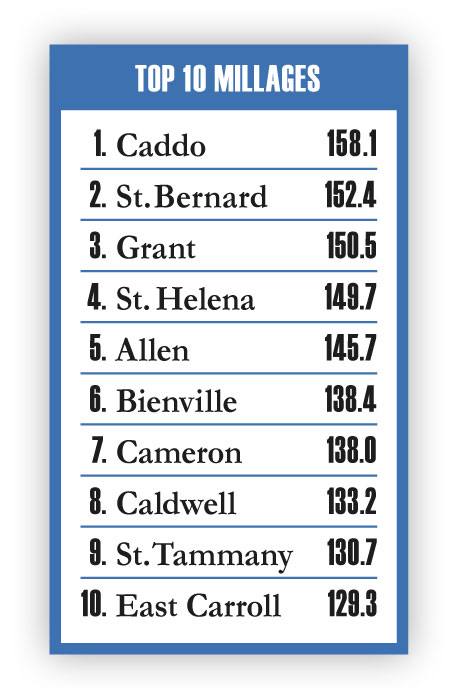

I’m pleased to report that 34 of 38 taxing bodies chose to roll back their millages for 2024, delivering meaningful tax savings to property owners. Every four years, adjusted millage rates are calculated, set, and approved by the Louisiana Legislative Auditor, after which taxing agencies vote to adopt a rate anywhere between zero and their maximum authorized amount. I’m proud to share that my office has once again lowered its millage rate, and I continue to encourage all taxing bodies to demonstrate fiscal restraint and good governance.

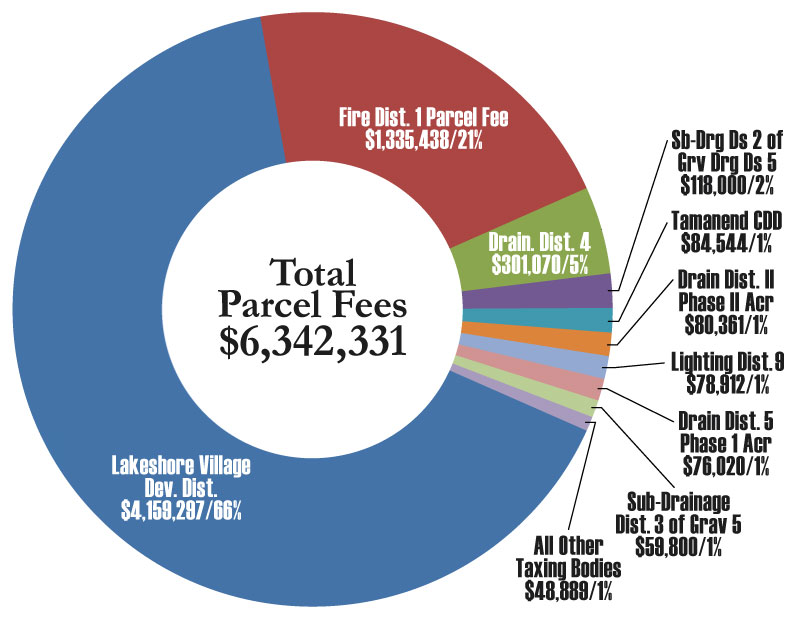

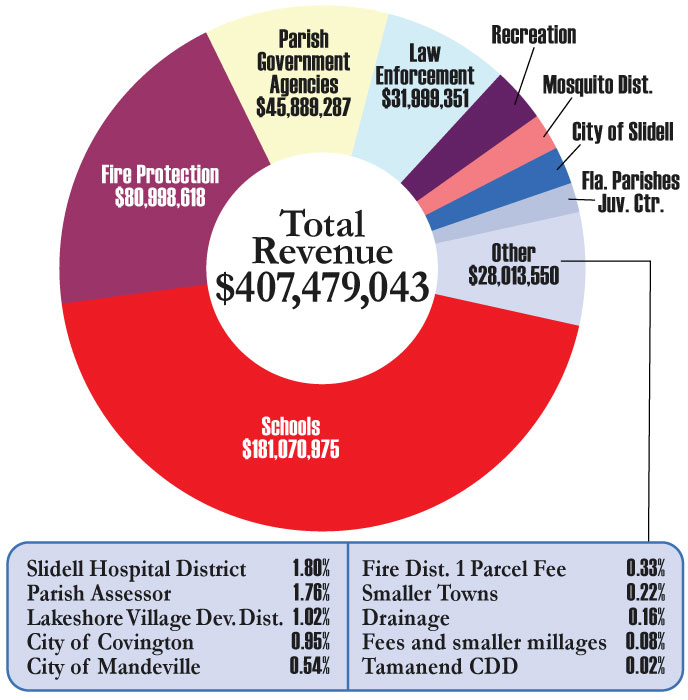

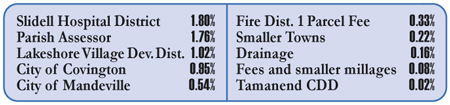

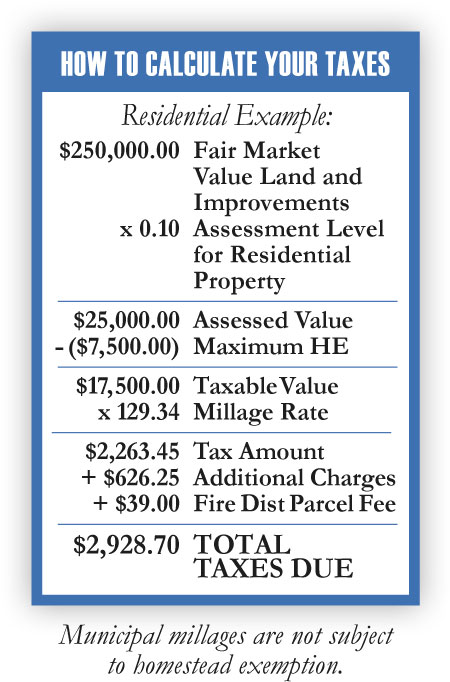

All property taxes in Louisiana are either constitutional or approved by voters. However, in many cases, the actual decision to raise or lower your taxes is not made by the elected officials that voters might assume are responsible, but by appointed volunteers who sit on various boards and commissions. I believe it is essential that taxpayers are aware of this process and how these decisions are made. I will continue to do everything I can to keep the public informed of any tax implications as taxing bodies proceed with setting their millage rates.

While millages remain an important part of the discussion, we must also address reforms that deliver lasting relief to homeowners. One critical step is raising the Homestead Exemption. It has remained fixed at $75,000 since 1980, despite decades of inflation, rising home prices, and increasing costs of living. What once offered protection to homeowners no longer reflects the economic realities we live in today. A modernized exemption—doubled to $150,000—would better serve Louisiana’s homeowners. I have called for this change for years, and I will continue to do so on behalf of the citizens I represent. I encourage taxpayers to reach out to their legislators and voice their support for increasing the Homestead Exemption.

Transparency and service remain central to everything we do. Our office offers a full range of public services and information through our website, including GIS parcel data, assessment values, online forms for exemptions and special assessments, detailed millage histories, educational materials and videos, and online business personal property filing—in addition to the certified tax roll itself. We are committed to making the assessment process as clear and accessible as possible, and to ensuring that every taxpayer understands their rights and responsibilities. Please utilize STPAO.org and the wealth of information on it.

As always, it is my mission to serve the citizens of St. Tammany Parish with fairness, efficiency, and responsiveness. I understand that every assessment affects someone’s pocketbook, and I take that responsibility seriously. I will continue to use every tool at my disposal to deliver accurate assessments, exceptional public service, and full transparency in everything we do.

Thank you for allowing me to serve you.